I wonder what an anthropologist from 12,000 AD would think of staples.

SFC Alwyn Cashe is getting the Medal of Honor

SFC Celiz and MSG Plumlee clearly deserved it as well, but I hadn’t been tracking their statuses. SFC Cashe I had known about. The awardees performed acts of pure heroism and wartime valor. If an award like the MoH exists and is distributed honestly, they should get it. I’m glad they did.

The family of SFC Cashe has also behaved honorably in the face of what must have been immense frustration. They didn’t get drawn into politics or side issues; they stayed focused on the matter. The nature of the Army lends itself to bureaucracy, and SFC Cashe’s family did themselves and him proud by staying on target.

It’s worth pointing out how important things like the MoH are to bereaved families. Medals like this matter. They matter to people like me, watching from the silent majority, and the families who want recognition of what went into their loss. They don’t have Alwyn Cashe anymore, and they deserve some recognition that what happened, the events that took SFC from them, mattered, and his going was as important as it felt. It’s simple affirmation of sacrifice, and sacrifices like this earn it. People, the departed, the survivors, and the bereft, need that kind of affirmation.

This is a good thing, and credit to the Biden administration for getting it done.

Mara

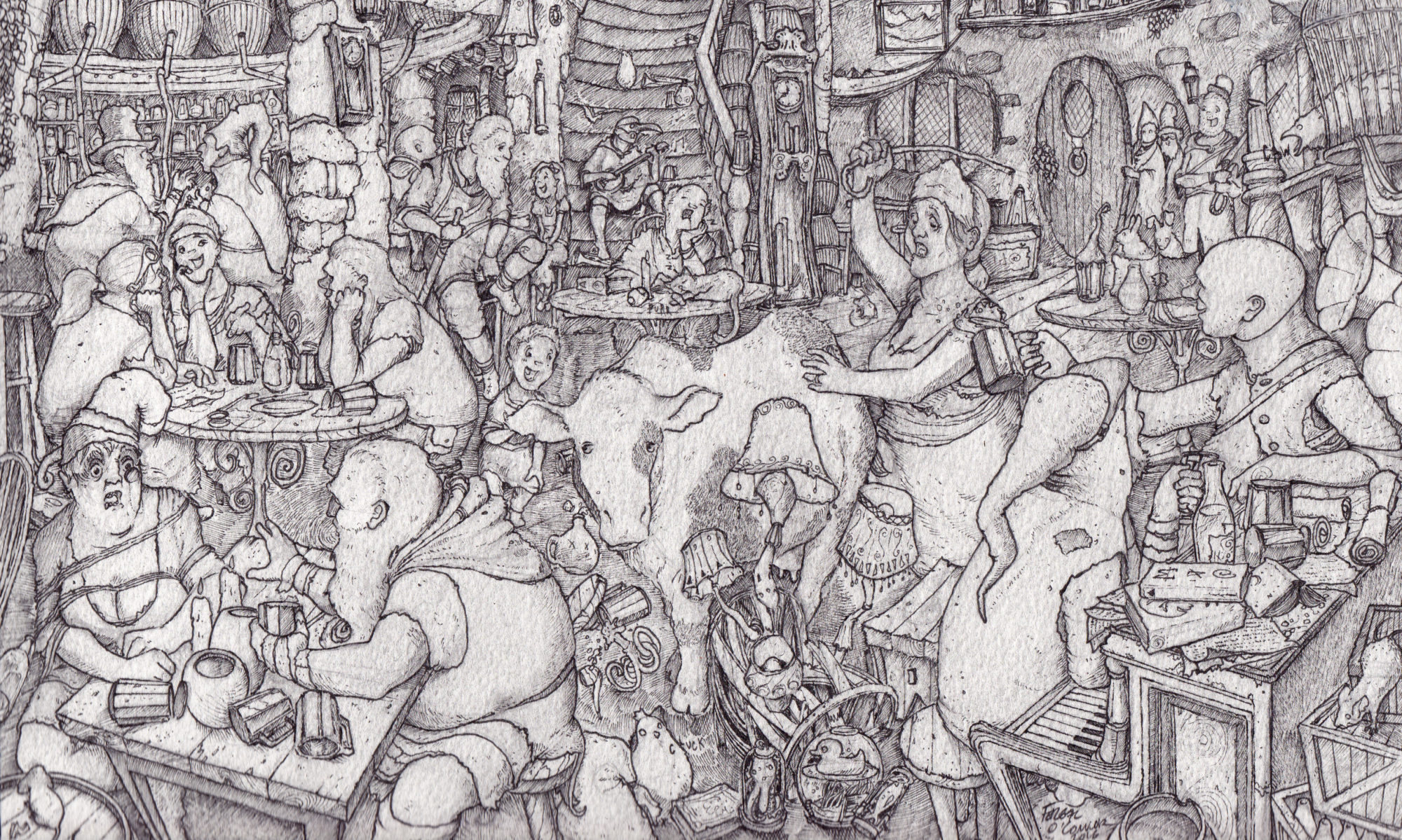

Thank you everyone who bought the book or downloaded the ebook. Mara has been going strong, and it’s nice to see it move.

If you liked it, please leave a review. It gives me a little feedback, and lets me know my work isn’t disappearing into the void.

Mara

Mara is free on Kindle this weekend. Please buy it so I can quit my job.

I’m reading Campbell’s Hero of a Thousand Faces, and it’s a slog. The ideas are good, but facts are getting shoved into theories. Doyle warned us about that.

Character Building

If there’s something mechanically I want to work on, I’m not sure if the best way to do that is make a character really good at it or really bad.

I got some bad guys, and I want to disclose their motivations. They do some things for reasons that are obvious if their motivations are known and bizarre if not. So do I make a character highly empathic, so they know these motivations, or non-empathic, so they have to struggle and find out? The readers will, hopefully, struggle along with the characters.

I bet this is one of those balance things.

Status

I like good mechanical pencils more than traditional pencils, but traditional more than mediocre mechanical. Grindy-type pencil sharpeners are all but essential.

Deflation

The problem with deflation is ‘what about other people?’

Suppose the prices of windows are going down. Suppose you need windows. You might consider holding off on a purchase to see if window prices go down further.

Suppose other people also look at falling window prices and hold off on buying windows to see if windows go down further.

Obviously, far fewer people are buying windows, so the windows installers, manufacturers, and shippers are going to be struggling. Some will go out of business. Others will tighten their belts. The net effect is they spend less money, which causes slowdowns in other industries, and so on and so forth.

For you alone, falling prices are a good thing. For an economy with other people, falling prices may be a bad thing.

Economic orthodoxy holds that falling prices are bad things almost all the time, and that ‘almost all the time’ is what I want to pick a fight with.

First of all, there will be some rising and falling prices all the time due to market fluctuations. If Alice the window installer wants to take a vacation in Cancun, she might have a sale on windows to drum up some business. Very few, if any, markets are perfectly liquid, so Alice’s window sale will influence prices briefly. That’s not bad. She needs to go to Cancun, and those mild perturbations keep market from getting too static. Markets lock up if they can, forming temporary metastabilities, but those metastabilities often break. The longer they’ve existed, the more violent the dislocation when they do break, so preemptive agitation, perturbations, can make a given market long-term more stable at the cost of short term instability.

An aside, if Bob wants to buy some windows and he hears Alice had a sale but Bob missed it, Bob will be slightly more aggressive in looking for sales for other window installers. Bob is now acting to make his purchases more efficiently. This is not a huge issue, but little improvements in market stability and liquidity are good. Little improvements add up to big ones.

Secondly, time dependencies can be real world driven, not market driven. These can lead to long term structural improvements. Suppose you want to sell some pumpkins. It’s December. You’ve got a problem.

The price of pumpkins in December is low, with demand, but if some pumpkin seller has some, the seller might find a way to make it work. This is not dissimilar from the way 3M invented Post-it notes. They had some adhesive, went looking for a product, and made a good one. Post-it notes are legitimately useful. Whine and complain about office culture all you want, but I got stuff I gotta mark.

So if other people have some product and the price went down (3M adhesives, etc.), they may find utility in them, and that can be a boon.

Economists tend to be freakishly obsessed with everyone marching in lockstep, so the counter arguments to this will consist of infantile shrieking about markets falling as a whole. It’s that ‘almost all the time’ issue.

A third issue, and a big one, is that the primary negative action associated with deflation is ‘lots of people stop buying something’. If that’s already happened, due to high prices, defacto deflation may be the only way to fix a market instability, shock an illiquid market out of a metastability rut, and induce better, more efficient decision-making later.

What more often happens is that who’s buying something bifurcates. Rich people or financial institutions keep buying appreciating assets, while poorer people don’t.

When a transaction occurs, the transaction can be measured on five axis: money, stuff, certainty, time, and emotional feedback. Money is money, and pure money transactions exist. See forex. Stuff is the immediate, physical utility of something. Candy bars can be eaten. Houses can be lived in. If you buy a candy bar to eat it, you’re buying stuff. Time is a bit more nebulous, but it’s how loans work. When someone gets a mortgage, they’re buying time from the lender. They get money now and in exchange pay the lender more money later. They got time. This is usually used to buy a house or residence now. In theory those are two separate transactions, but in real world practice, they get bundled together. Certainty is what you buy insurance for. I didn’t buy car insurance hoping it would pay off. I want my car insurance premiums to be wasted money. But I’ve got a plan because if something happens, I want the certainty an insurance plan provides.

Emotional satisfaction is nebulous but the most easily understood. When you eat your candy bar, you have no candy bar any more, but it tasted delicious. Donations to charities, buying wrapping paper from one of the neighborhood school kids, giving money to a church, all that is mostly a matter of emotional satisfaction. There are exceptions to this, and I won’t argue it’s a concrete, well defined area, but it’s still pretty understandable.

Regarding property purchases, the stuff aspect is living in it. Once you have a place to live, increased utility from the stuff of a house falls off sharply. Someone who buys a vacation house isn’t going to live there nearly as much as their primary residence, and so on down the line. This is the utility, the stuff aspect, of buying residential property.

Other people exist. Those people may be Rich, Financial Institutions, or Speculators (RFIS). They may not buy a house for the utility aspect; they want price stability and implicit central bank price guarantees. They may want stable rental income. They may want these things so badly that they buy all the homes, meaning people who want to buy homes for stuff/utility aspects can’t.

Then the various groups come into conflict, and some price deflation may be useful.

For long time societal stability, people living in homes they nominally own seems to be a very good thing. But they can’t do that if the RFIS buy all the homes. Much like with deflation, the best outcome for RFIS is no one else can buy homes, but they can. Unfortunately, this is not dissimilar from the owner-occupant would-be home purchases who want the stability and price increases of CB mandates and inflation protection. It’s best for them if they can buy homes and the rest are protected by RFIS.

Other people exist.

So which is right, almost all the time? Whichever side you’re on, of course. And once the utter meaningless of that conclusion is fully appreciated, maybe deflation isn’t a bad thing all the time, and maybe price stability isn’t a good thing all the time either.

Wheel of Time books vs Prime series

There was a magic in the books. They had a lot of problems, and those problems won out in the end. I didn’t finish the series. But there was also a magic in them.

The streaming series eliminated most of the problems and the magic.

The series is going slowly, and not a lot happens. The books were a slow burn at best. But the characters aren’t yearning for anything. They don’t have obvious driving desires. They’re all just going along, and they don’t carry the readers. There’s not a lot of action but a lot of violence, often terrible. It succeeds in demonstrating violence is bad and the world is rough. But now I don’t want to see it.

Action is exciting, fun violence. Of course it’s absurd, but movies are.

And so I don’t really get the point of the series, nor am I particularly engaged. It’s well made but boring. The scenery is nice.

LaL

I did something stupid, and I’m annoyed with myself for it.

Live and learn, eh?

Clicks

The longer stories just get more views. Word count seems to be the primary determining feature.