Discrete and discreet are two different words. Discrete is distinct/separate, and discreet is quiet, subtle, or showing good judgement.

I never knew that.

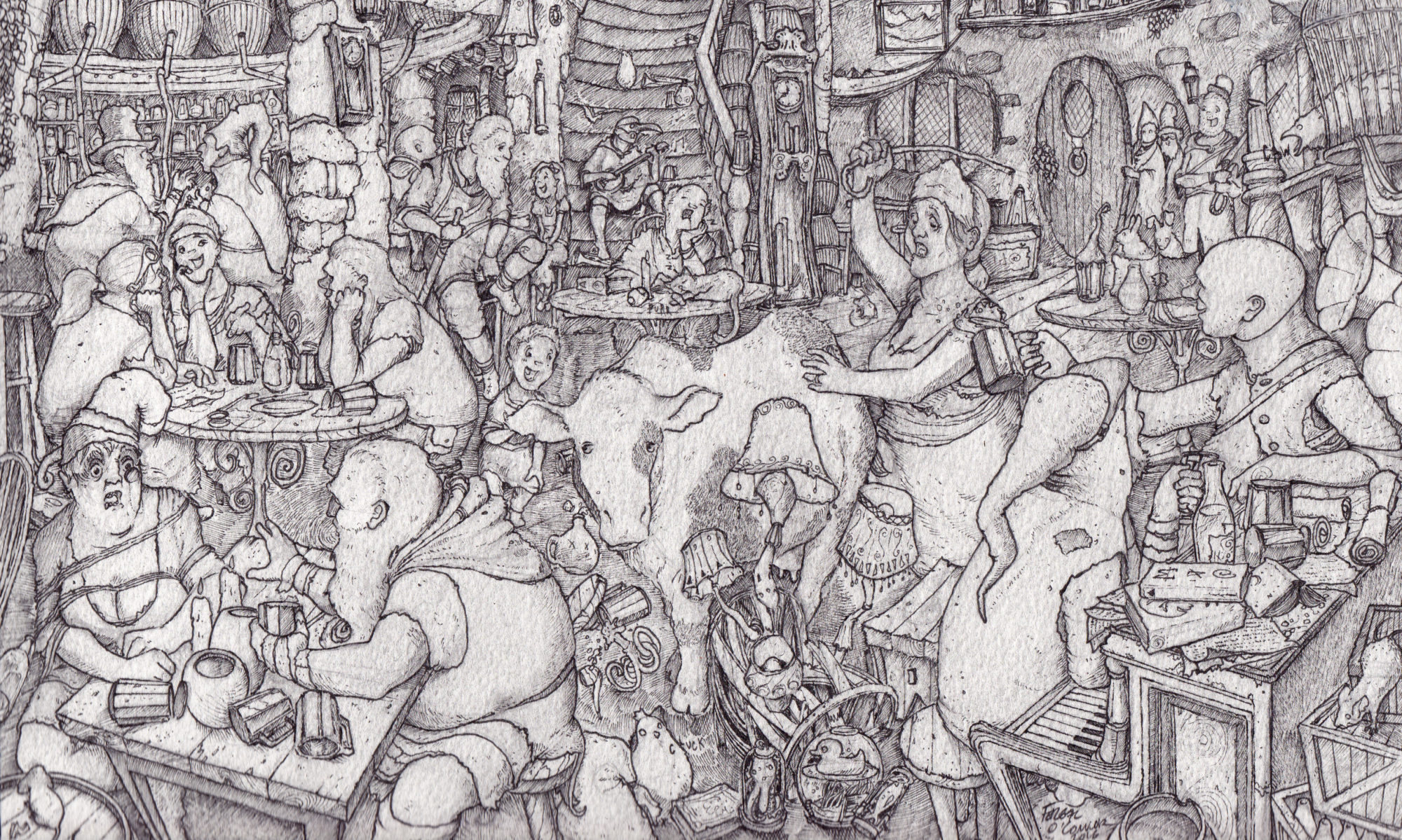

For dragon enthusiasts

Discrete and discreet are two different words. Discrete is distinct/separate, and discreet is quiet, subtle, or showing good judgement.

I never knew that.

The Drive just had an article about Boeing’s ongoing failure to make a decent aerial refueling vehicle.

Thinking of Boeing, they have three major problems.

1) The 737 Max debacle

2) The Starliner failure

3) The KC 46 dumpster fire

Efforts to cut costs and separate the engineering sections from the management have damned the company.

Boeing has not yet cut their dividend. Nothing hurts yet.

I’ve been following it and as it hits 15 hours away, I have finally come to a true thought, one I believe completely.

I wish you all the best. I wish the UK, EU, and associated parties the best luck going forward. I hope you all get the best outcome in this timeline.

That goes for the sides I disagree with as much or more than those I agree with. For a while I avoided this conclusion because it sounded like a cop-out, but I don’t think it is. The UK and EU are T. Roosevelt’s men in the arena, and I have no criticism from the bleachers. Good luck to all of you.

I’ve just gotten a flu shot a couple days ago, and now my entire shoulder is sore. Specifically the lateral deltoid, the muscle I got the shot in, hurts with the ache centered on the injection site, but there’s a hint of aching all over that shoulder. This is a listed side-effect, and the paper says contact a doctor if it doesn’t go away in a few days. The paper says there’s nothing to worry about.

However I know the truth: I have Elephant Man Disease.

It’s unrelated to the shot. They just happened to coincide in timing! This is it: my doom. Goodbye cruel world; you’re getting so dark.

In light of some current events, I’ve been thinking about ethics in public officials. Specifically, I’ve been thinking about what is impeachable.

Ethics for public officials are and must be different than for private citizens.

I have a friend who managed a bikeshop. On weekdays he closed at 7 pm. One day a customer came in at 6:30 with a two hour repair.

My friend said, “Come back tomorrow around noon, and it will be ready.”

The customer replied, “I need it tonight. I have a race tomorrow morning.”

My friend demurred. “It’s a two hour job, and I close in thirty minutes.”

The customer said, “I’ll give you a hundred dollars plus whatever the cost of the repair is.”

“Come back in two hours,” and my friend stayed open to get it done.

I think that’s perfectly reasonable for him. He’s in business to make money, bikes are his money, and the customer paid a little extra to get something a little extra.

But imagine the same situation for, say, a border guard.

BG: “The crossing is closed for the night.”

Customer: “I’ll give you a hundred dollars to keep it open for me.”

That’s clearly wrong. What’s more, that’s not just bad behavior; that should be illegal.

Boeing and Nissan are classic examples of cutting costs too far. You do have to spend money to make money, and if you cut expenses to the bone, it explodes on you.

I’ve been listening to a fair bit of Perturbator recently. I saw him live outside Baltimore, and it was a short music-festival set, 30 minutes or so. Lively. He got me into synthwave. Strong recommend.

I’d like to see labor unions use their bargaining power to get better health insurance or student loan help for their members.

I struggle to stay positive.