Dealing with AirBnB is a lot like dealing with pushy used car salesmen: spam I can’t opt out of, texts I can’t opt out of, and pushy messages when I just wanted to ask a question.

Selective reality

One of the Evil Overlord Tips is “My secret lair will have ventilation shafts too small to crawl through.”

Do the people who write these lists realize that henchmen* have to breathe?

Poor ventilation kills a lot of people in poorer countries today. Not only do poisonous gases get trapped, but diseases spread quickly. The army of henchmen will all have pneumonia and influenza within a few weeks if they’re working in a poorly ventilated stuffy lair. Now this may explain the general incompetence of persons of hench, but I can’t imagine any evil overlord intentionally deciding to give everyone the flu. So the lair needs big aircon systems. Which need large vent shafts. Plus, if the evil overlord is manufacturing explosive doom chemicals in-lair, those doom chemicals are going to need ventilation. Does the overlord want to compress his doom-chemicals in high-flow, low cross-section ventilation shafts?

What’s going on here is the notion that I can attack you with common sense, but you can’t attack me. If I point out the security failings of large vent shafts, you’re not allowed to point out that otherwise all of my henchmen will have pneumonia. Teddy Roosevelt had a message about this.

*I say henchmen, because it’s almost always men. If an evil overlord has an army, the movie is going to be directed at men. Therefore the main character will almost always be a man so the primary audience can identify with him. If the hero breaks into a lair and beats up a bunch of male henchmen it’s a good action sequence, but if he beats up a bunch of recognizable human women, it’s problematic. So the minions have to be insects, aliens, other creatures, or men. Male actors in uniforms are a lot cheaper than good CGI.

At least for action movies, but I haven’t seen any evil overlords with lairs full of henchmen in not-action movies. I’m very curious if there are any exceptions.

Spambot

My spambot came back! He was away for so long, I got worried! We shall call him Loblot Spambot.

Chris Tolkien

Chris Tolkien died. The world is better for him having been in it.

Chris put a great deal of work into preparing and publishing his father’s work for popular consumption, and Children of Hurin is and was one of the great Middle Earth works. But I’ve heard another story a few times.

The Hobbit started out as a bedtime story John (JRR) told his kids. As he told it, he would get details confused and mixed up. Thorin would have a blue hood one day and a purple the next. Chris bugged his father about this until in a fit of pique JRR wrote the whole thing down.

And thus we have the Hobbit and later the Lord of the Rings. More directly the Silmarillion, Histories, Unfinished Tales, and more.

The world is a better place for them having been in it.

Workout Plan 7

I suppose it’s worth discussing A) why I do any of this B) why I do what I do specifically and C) why anyone would care.

A) Weight lifting is an extremely simple empowering activity. There is little or no complexity. I know when I’m done.

As a physicist/engineer by education and trade, most of my problems are complicated. There’s not a whole lot of simplicity, and you can’t think harder when confronted by difficult math. The usual way to overcome difficult math is think easier, think from different angles, run down a hundred possible solutions and do so lightly so frustration doesn’t set in. There’s none of that in weight lifting. You just pick the bar up, run the miles, do the stretch. You know when you’re done because you’ve finished the schedule or you can’t lift/move/bend anymore. It’s over. It’s done. The task is completed, and there is nothing left but resting and recharging.

B) No particular reason. I used to run a lot, and I’ve gotten out of that. Now I like hiking and even aggressive hiking like the Incline is simpler than old running. But the weights are just complicated enough to do a little math and a little planning. They’re also close. Getting up to the hills, even from Denver, takes a little time, planning, good weather, and gas. The gym’s a few miles from my apartment.

I suppose there’s a physical sense of accomplishment and pleasant fatigue. I don’t notice that much, but I do like being able to carry boxes from my apartment to car easily.

C) These posts are more writing exercise than anything else. If you’re interested in what I spend my time on, this struck me as more interesting than counting uses of ‘said’ and chasing down dialogue tags. Do I always hyphenate this phrase like so? I cannot imagine anyone would like to read about that. I don’t want to do it, but it’s important.

Week reset for Bench Day!

Warmups: See before. I threw in some side lunges where I squat, stick a leg sideways, slide over, and stand up from there, going back and forth ten/twenty times. Those help the soreness from real squatting. As always, the purpose is just an elevated heartrate, so I’m not too picky.

Bench:

3×70%

10 Jump squats with 18# medicine ball

3×80%

10 Jump squats with 18# medicine ball

3+x90%

10 Jump squats with 18# medicine ball

Heavy weight:

1×95%

Pullups

1×95%

PU

1×95%

PU

Assistance: I didn’t do any math on these numbers. I just put round numbers of plates on bars. DL was with a hex bar.

5×65%

5x DL 40%

5×65%

5x DL 40%

5×65%

5x DL 40%

5×65%

5x DL 40%

5×65%

5x DL 40%

Hit a wall on the last set of bench and my spotter basically pulled the bar off me at rep 4 or 5. I was done. Closer to acclimatization, but not there yet.

Grad School

I’m doing the grad school thing, and God, it’s frustrating.

I don’t know what to say here other than a long screed, which I don’t want to write any more than you want to read it. I suppose the productive thing to do is try to focus on the positives. That’s similar, but not the same, as ignore the negatives, and I’m mindful that having the opportunity to go to grad school still puts me in rarified and lucky company.

Ah, but it’s frustrating.

Re: Dragons

Or vampires…

Workout Plan 6

I took yesterday off and did some walking, little else. I came back around 80% today and was able to get some work done.

Squat day! I use a safety bar, the big yoke-looking thing with the long arms and pad, due to an old elbow injury. It works for me, so there’s no sense in changing. It doesn’t work my upper back and chest quite as much as a barbell, but that can be compensated for in other ways.

Warmups: Same as typical. See before.

Work: Objective is improve leg strength, burn calories, and prepare myself for vigorous outdoor leg-work in the form of hiking.

Assistance work was sledgehammer/tire work or pushups.

5×65%

SH

5×75%

SH

5+x85% (saw spots)

SH

Heavy weight:

Did some heavy weight here. It was rough. NB: the 100% below (and all other percentages) refers to my training max, which is below a true max. This difference gives me a margin of safety so I can push harder with less risk. I started years ago by calculating 90% of my 1rep max and using that as a training max, and all calculations and training modifications adjust this number. Having done this cycle for a while, my training max has climbed from the 90% of true max, and I’m not sure where the numbers are in relation to each other any more.

1×100%

Pushups

1×100%

Pushups

1×100%

Pushups

Assistance work:

Objective was support the squatting. Someone else was using the trap bar, and I usually use that for assistance. No matter. I was almost out of gas anyway.

5×70%

SH

5×70%

SH

5×70%

SH

Kroc rows

I was a little dizzy and lightheaded leaving, so I went home, drank a ton of water, ate a big meal, and rested.

Tomorrow I can start the cycle over and bench, in which case I’ll rest Wednesday and do DL Thurs, or rest tomorrow and do Bench/DL Wed/Thurs respectively. Sledgehammer work is a hell of a core exercise. I don’t get to do it very often because it takes up a lot of gym real estate, but it’s a good time when I can. That kind of stability work is invaluable for hiking with a pack, as it strengthens the load bearing muscles and the spine sandwich. Nothing sucks more than being ten miles from my car with a pack I thought I could handle.

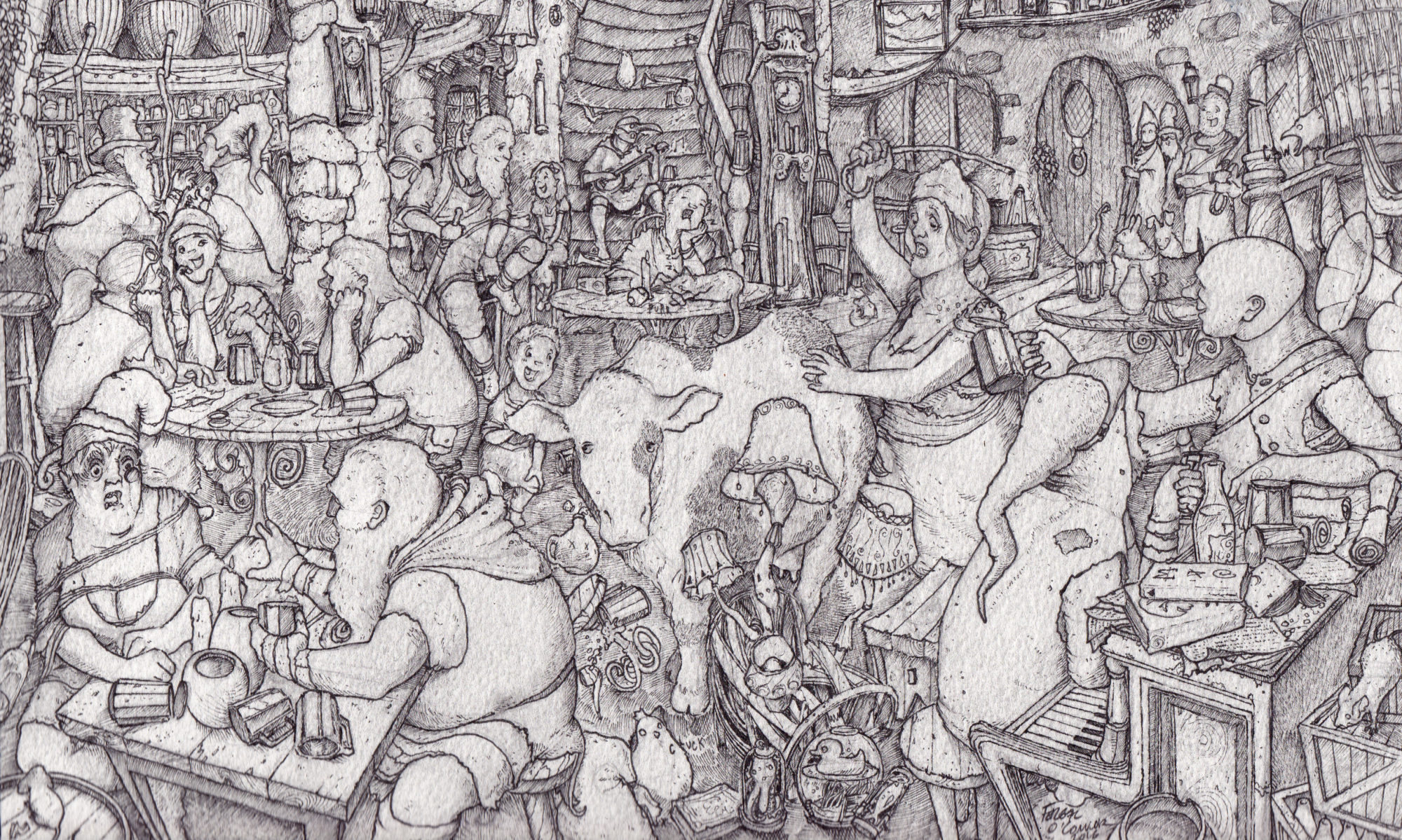

Dragons

Need some dragons in here.

Workout Plan 5

So today was pushpress day, and I was struggling.

Warmups: usual stuff, see days 1 and 2

Primary work: Pushpress is a solid, all body exercise. I do elbows to knees pushpress, which sometimes gets called a front squat to shoulder press. The objective is total body work, with a strong focus on core and legs, and building explosive power. I try to move the bar upwards as fast as possible and lower it slowly. While in general that’s the objective of all lifts, it’s a strong focus in this one because going from a front squat to a full vertical involves so much stabilizing.

I was dying. Just getting the sets was a labor, so no assistance on primary work.

5×65% pushpress

5×75% pushpress

5+x85% pushpress

Assistance work:

Still felt terrible. Had a hard time breathing, kept burping, and never got that I’m-ready feeling. Skipped heavy weight to do assistance.

5×50% pushpress

5 pullups

5×50% PP

5 PU

5×50% PP

5 PU

5×50% PP

5 PU

5×50% PP

5 PU

Just a hard day. I’m glad it’s done.