US 10 year yields are now over 1.6%.

Within the last few months, I’ve seen predictions regarding three major levels: 1.15, 1.3, and 1.58 (more specifically, the US S&P 500 dividend yield, which at the time was about 1.58. All numbers percent). All have been blown past, and the market has climbed with only its usual jitter. At every phase, someone predicted the current bull market would die. Rumors of its demise have been greatly exaggerated.

The yield curve is steepening rapidly. It’s not very steep in absolute terms, with 3mos. yielding basically nothing (0.025% or 2.5 bp; careful about those units) and the 30 year at 2.38%. In relative terms that’s a different of about 100x, but in absolute terms, it’s only ~2.35%. Of course, percentages are inherently relative, but that’s a story for another day. What is key is that steep yield curves are good for bond investors, provided the curve is both steep and stable.

I’ve seen it said that all bear markets are inherently liquidity events. That word ‘all’ makes me squirrelly, but if the ‘all’ is taken out or replaced with a ‘usually’ or ‘often’, perhaps some remark about correlations near 1, that statement does have some truth to it.

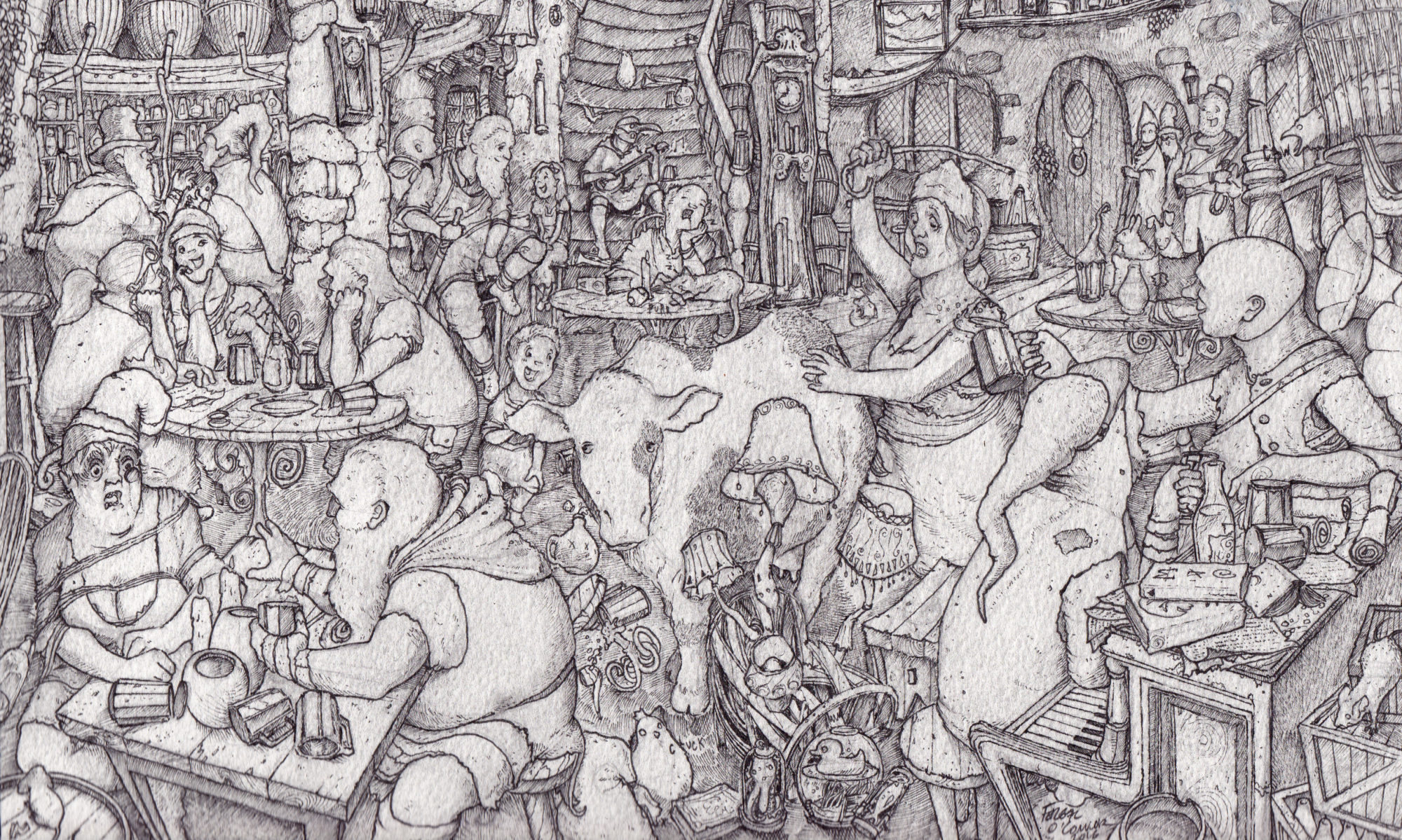

I don’t think we’re partying like it’s 1928. I do think we’re partying like 1963 +/- 5 years.

How would I trade that? A push into non-financial assets, tangible assets (like property) being one and IP being another. Of course those lead to inflation, which create a self-fulfilling prophecy.

Or spend your money.